Cutting-edge gene-sequencing giant BGI Genomics Co. will make its debut on China’s domestic bourse after several failed attempts at a foreign float. The world’s largest provider of genome sequencing services is planning to raise 1.73 billion yuan ($251 million) on Shenzhen Stock Exchange’s Nasdaq-style ChiNext board.

A financial prospectus document released to support the initial public offering (IPO) details how BGI, squeezed by its rivals and the plummeting cost of sequencing, has been drawn to more-profitable pursuits, such as prenatal genetic testing, in China’s expanding medical market. The shift is also in line with the Chinese government’s multibillion-yuan drive to promote precision medicine, an effort to use the reams of genomic and other medical data being created to tailor treatments.

As the first genomics company to be listed in China, BGI will be a pioneer in the country’s precision-medicine market, which is estimated to be worth 20 billion yuan by 2020. The 16-year-old Chinese biotechnology group began as a government-funded laboratory, and started to commercialize its findings in 2012. Since then the genome giant has been a hotbed for institutional investment, with financing from China Life Insurance Co., Ltd., Citic’s Goldstone Investment, billionaire Jack Ma’s Yunfeng Capital, and SoftBank China Capital.

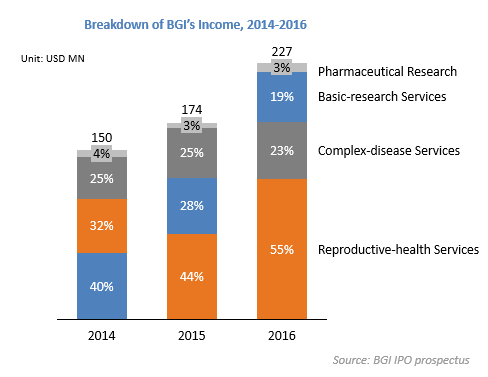

At its early days, BGI produced a series of high-profile sequencing breakthroughs and gained reputation among scientists all over the world, who acknowledged BGI scientists’ contributions by making them co-authors. Yet according to the prospectus, BGI’s income from research-driven sequencing dropped by more than one-quarter between 2014 and 2016, and now accounts for less than 20% of its business, down from 40% in 2014. Reproductive-health screening makes up the lion’s share of the company's income, at 55% (see ‘Focus on health’). Services related to complex diseases — those caused by a combination of genetic and environmental factors — brings in 23%.

This shift seems to be market driven as facilities for large-scale research sequencing are available on a more-competitive pricing, or nearer by, elsewhere. Meanwhile, BGI’s ability to keep pace in the research was also affected by its failure to develop an advanced sequencer based on technology that it bought in 2013 from Complete Genomics in Mountain View, California. It also suffered after the departure of its chief executive Jun Wang, who spearheaded many of BGI’s research projects, but left in 2015 to start his own company.

Clinical sequencing in China, however, is booming, fueled by the country’s growing middle class, expanding health-care system and focus on precision medicine. Sales of BGI’s non-invasive prenatal testing kit, NIFTY — which screens maternal blood to determine whether a fetus has chromosomal abnormalities such as Down’s syndrome — passed the million mark in March 2016. And China’s move from a one-child to two-child policy in 2016 increased the birth rate among NIFTY’s target demographic: women in their late 30s who are considered to be high risk for chromosomal abnormalities. According to an analysis by Chinese investment bank CITIC Securities, BGI has nearly 50% of the prenatal screening market in China, far ahead of its closest competitor.

With the money raised from its IPO, the firm hopes to improve its reproductive and cancer-diagnosis technologies, and add other, similar, sequencing-based diagnostic services for other health conditions. It also plans to expand genetic consulting services and establish cloud-computing platforms to crunch genomic data for precision medicine. Earlier this year, BGI struck a deal with Foxconn — the Taiwanese company that manufactures iPhones at its base in Shenzhen — to mass-produce sequencers, which BGI plans to sell to hospitals throughout China.